Leadership is vital to the success of any organisation, and the mutual sector – where purpose and values are fundamental to everything we do – is no exception. Our strategies and the energies of our people need to be directed to achieving that core purpose of serving our members for the benefit of our communities and society.

Leadership is vital to the success of any organisation, and the mutual sector – where purpose and values are fundamental to everything we do – is no exception. Our strategies and the energies of our people need to be directed to achieving that core purpose of serving our members for the benefit of our communities and society.

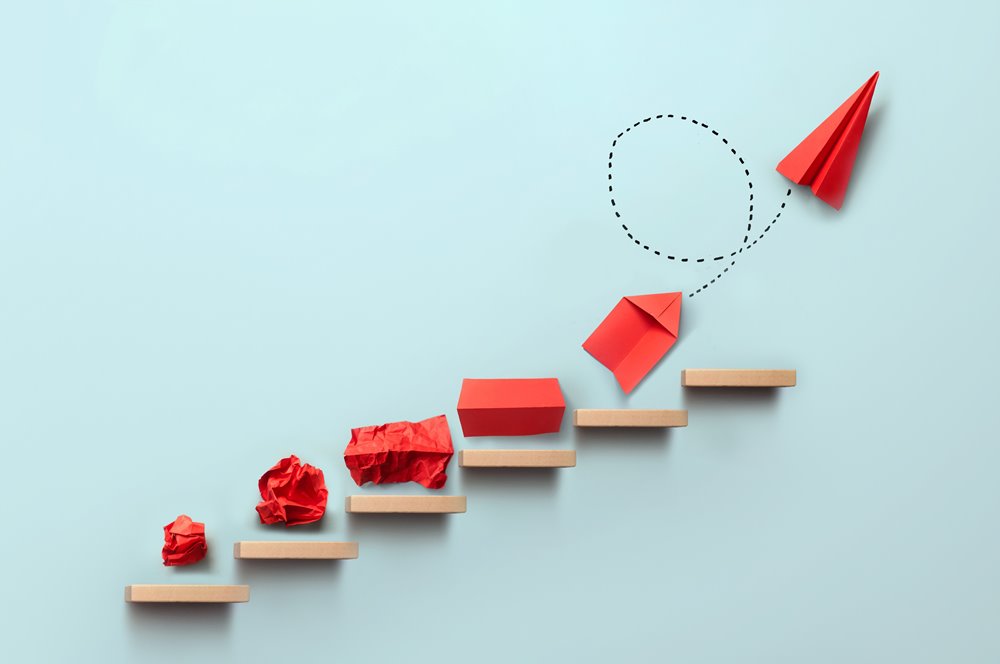

The economic and social uncertainty which has brought real challenges for our members over the last few years doesn’t look likely to change soon. So, what we do, and the way we do it, has never been more important than now. That in turn brings challenges for us – to be the best we can be, delivering for our members to the highest professional standards, meeting their needs and supporting their aspirations with the most efficient and effective operations. Which brings us back to leadership.

One of the special things about this MSc in Strategic Leadership is that it recognises the distinctive nature of mutuals and includes bespoke modules designed to address some of the particular challenges and opportunities we face. This is combined with learning alongside students from many other sectors – broadening our perspectives, exposing us to different ideas and ways of working, and promoting diversity of thought.

Since the programme started in 2015, 145 students have joined the MSc and 98 have now graduated after three years of hard but rewarding study, many of them with merits or distinctions. Many BSA and AFM member firms see the MSc as a valuable part of their leadership development programmes. Many of our students have gone on to be promoted within their own organisations and have also gained a valuable extra – a lasting network of mutual colleagues. The programme is open to all financial mutual businesses, whether they are members of the BSA, AFM or not.

Employers have the choice of their students following an apprenticeship, with its funding support for levy and non-levy payers alike, or the non-apprenticeship route. You can find out more about each of these routes in this prospectus.

2025 sees us celebrating both the 250th anniversary of the first building society and the 10th anniversary of the MSc programme. Since the programme’s launch it has consistently evolved, just as our business environment has changed, but we have always maintained ‘mutuality’ as an important core theme.

Having an Advisory Board which includes the BSA and AFM – together with a number of large, medium and smaller member firms – has ensured that the programme continues to meet the needs and ambitions of students and employers alike. This MSc is a great opportunity to invest in your own skills and development, and strengthen the future of our sector.

Find out more about the programme here

f055.png)